New Jersey Commercial Solar Incentives

NEW JERSEY is a solar energy leader in the United States

Incentives can translate into significant savings for commercial solar installations.

New Jersey continues to lead the nation in solar market growth, thanks to lower costs, solar grants, tax credits, and state incentives. By 2030, approximately 50% of New Jersey’s electricity is expected to come from clean renewable energy sources, with solar energy increasing from 7% in 2020 to 34% of New Jersey’s electricity by 2050.1

Renewable Energy Certificates (RECS)

The environmental attributes of solar energy are monetized through marketable units called Renewable Energy Certificates (RECs) – with a single REC created with each MWh of electricity generated.

In New Jersey, RECs are valued currently in what is referred to as the Successor Solar Incentive (SuSI) program, with a fixed 15 year-long value depending on the project type and size (see table below). For example, businesses that install a large net metered solar system on their rooftop or carport receive $90 per MWh, while a large net metered ground mounted solar system only receives $80 per MWh.

| Solar Installation Type | System Size (MWdc) | Proposed Incentive Value2 |

|---|---|---|

| Net Metered Residential - all types | Any size | $90 |

| Small Net Metered Non-Residential located on Rooftop, Carport, Canopy and Floating Solar | < 1 MW | $100 |

| Large Net Metered Non-Residential located on Rooftop, Carport, Canopy and Floating Solar | 1 MW to 5 MW | $90 |

| Small Net Metered Non-Residential Ground Mount | < 1 MW | $85 |

| Large Net Metered Non-Residential Ground Mount | 1 MW to 5 MW | $80 |

| LMI Community Solar | Up to 5 MW | $90 |

| Non-LMI Community Solar | Up to 5 MW | $70 |

| Interim Subsection | Any size | $100 |

The NJ SuSI program funding will continue until the capacity allocation is used up, so businesses should not wait to get started with a solar investment.

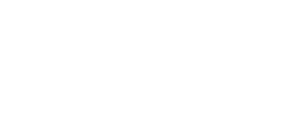

Federal Investment Tax Credit (ITC)

An incentive program that lowers commercial solar installation costs for New Jersey businesses. Under the Federal ITC program, businesses can receive a 26% tax credit for the installation of a solar project.

Please note, businesses should start commercial solar project construction before the end of 2022 to maximize financial tax credit incentives and savings.

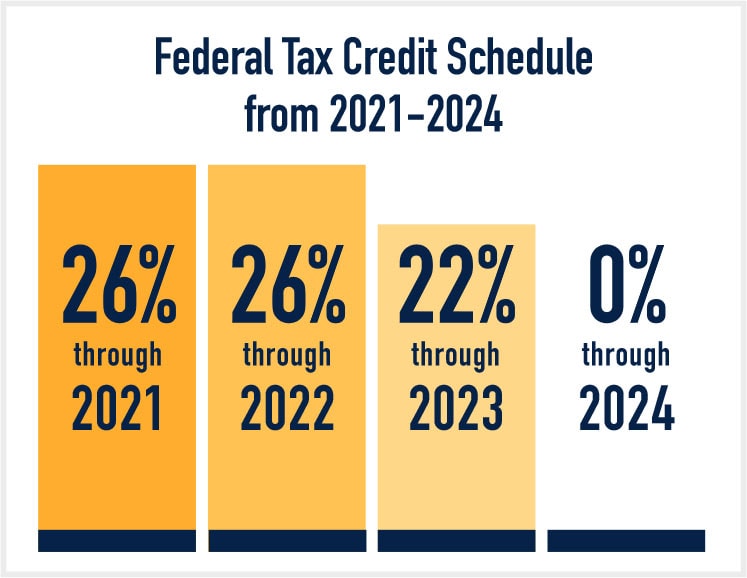

Net Metering

The utility billing function, where the electricity utility credits a business with solar for the excess solar electricity they generate and return into the grid — for example, on a sunny summer day when solar generation exceeds the consumption of the building.

Businesses can use these net metering credits towards a future billing period, providing greater flexibility, increased utility bill savings, and a shorter solar payback period or higher ROI.

Community Solar Energy Pilot Program

Residents and businesses virtually connect to a solar installation within their local utility service territory. This program benefits consumers usually excluded from the solar market (renters, shaded property, lack of roof control).

Property owners can sell or lease their property to solar developers who install and maintain the community solar farms anywhere in New Jersey, regardless of the area’s previous function.

In fact, New Jersey community solar programs are more likely to approve solar sites that repurpose or improve properties such as landfills, brownfields, condemned coal mines, and degraded lands.

Brownfields Redevelopment Incentive Program

Provides a tax credit of up to 40% or a maximum of $4 million to eligible projects. The program ends in 2027 and there is a cap of $50 million that can be awarded annually. Funding through the program will be granted through a competitive application process.

Other New Jersey Incentives

Sales Tax Exemption – 100% sales tax exemption on solar equipment.

Property Tax Exemption – 100% local property tax (no state property tax) exemption.

Assessment of Farmland Hosting Renewable Energy Systems – Assesses solar on agricultural land as farmland (no change in taxes).

Learn more about New Jersey Commercial Solar Incentives

Fill out the form below to receive access to the New Jersey Commercial Solar Incentives document.